housing loan tax reduction

I am Daisuke Abe, a sales representative.

The Mortgage Tax Credit Program is designed to reduce the burden of interest rates when borrowing to acquire a home.

The program allows 1% of the mortgage balance at the end of each year to be deducted from the amount of income tax over a 10-year period.

If not fully deducted from income tax, a portion will also be deducted from inhabitant tax.

Starting October 2019, the deduction period has been expanded to 13 years.

Custom homes must be under contract by the end of September 2021 and occupied by the end of December 2022.

The homes for sale must be under contract by the end of November 2021 and occupied by the end of December 2022.

The first two are the following.

So what happens if this contract deadline is not met?

If they move in during 2021, the deduction period will be 10 years.

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) responded that the applicability and number of years of mortgage tax breaks for occupancy after 2022 has not been determined.

The details of the homeownership deduction after October have not yet been determined, but many people seem to be saying that the maximum amount will be reduced. Many people are saying that the deduction of 1% is too much when the current mortgage interest rate is less than 1%….

I am concerned about the deduction rate, but I am also very concerned about the period of time. Sometimes the maximum deduction is 20 million yen, sometimes 50 million yen, and sometimes it is 10 years, sometimes 15 years, and sometimes it is 6 years.

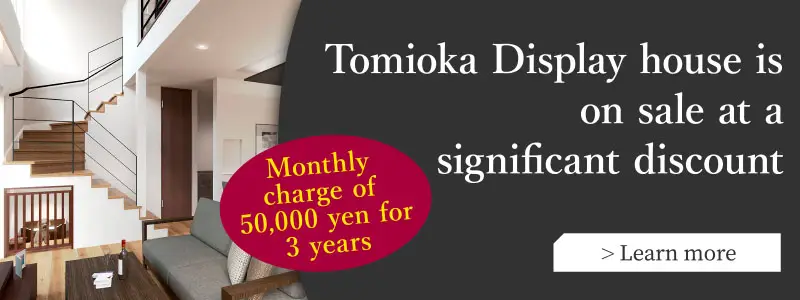

If you are considering a home for sale, you have until the end of November to sign a contract and take advantage of the 13-year tax credit…

Lid’s homes for sale are now offering double benefits to customers who sign a contract before the end of the year.

It was top salesman Daisuke Abe (laughs).